After calculating your net worth, you can start budgeting!

Step 1 : calculate your net worth

Step 2 : create a budget

Step 3 : pay off debt (excl. mortgage)

Step 4 : create an emergency fund

Step 5 : build a financial plan

Step 6 : invest and “stay the course”

Preparing a budget can be a difficult task, but when you prepare a budget properly, it does not have to take much time. A well-prepared budget gives you a clear view of your income and expenses and is the foundation for getting your finances in order.

Budgeting … easier said than done, but how do you get started?

There are 2 ways to keep track of a budget

- manually : on paper, the familiar household book, or a spreadsheet on the computer

- a budget app

The classical way

In the past, income and expenses, such as groceries, among others, were recorded in a household book to gain insight into one’s own finances.

The household book had its rise in the first half of the 20th century. It was mainly housewives who started recording expenses. Each expense was carefully tracked and recorded in a paper household book.

Wikipedia (1)

Today it is perfectly possible to keep track of your budget digitally, using a spreadsheet.

Getting started!

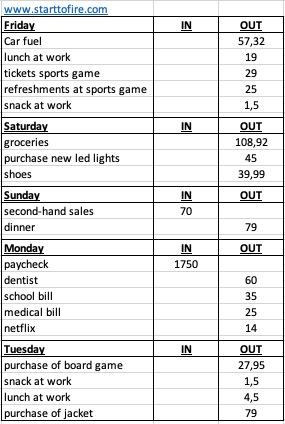

For an entire month, write down all your income and all your expenses, in as much detail as possible. Every day … this task only takes a few minutes a day and afterwards it gives you a clear understanding of your finances.

For inspiration, this is what a list of a few days might look like (disclaimer : fictitious amounts).

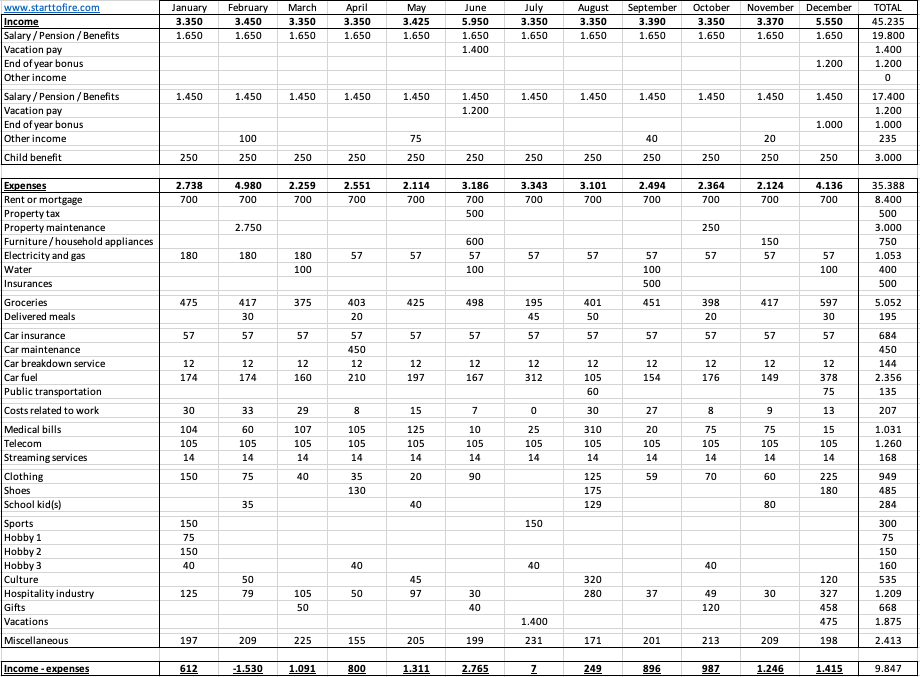

At the end of the month you make an overview of your income and expenses for that month. Below you can find an example for a complete year (disclaimer : fictitious amounts).

Belgian households spent an average of 35.764 euros in 2018.

Statbel (2)

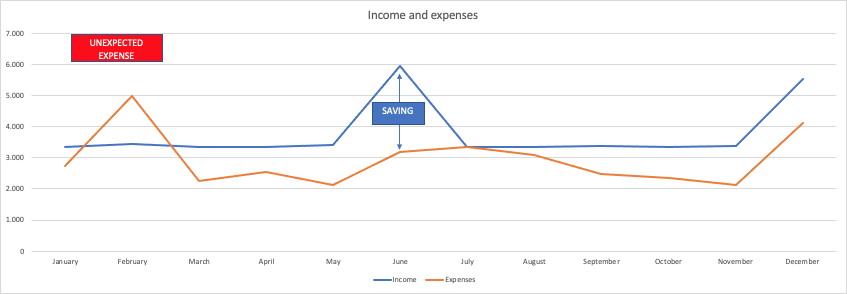

One picture says more than a thousand words : the same numbers in a graph.

Determine which expenses you consider important (and which expenses are not) and ask yourself where your priorities lie. The idea is to maximize the space in the chart between income and expenses, this is the amount you can save for an emergency fund, or you can use to invest.

In comparison, Belgians saved 13% of their disposable income in the year 2019 and saved 21% of their disposable income in the year 2020 (3).

In this fictional example, there was a large unexpected expense in the month of February, which is why the balance was also negative. You can deal with these unexpected expenses by saving up an emergency fund. You can also set aside a portion of your monthly budget for larger expenses, such as vacations, replacement of a car or home renovations.

Budgeting apps

Today, there are a significant number of budgeting apps available on the market.

The free Spendee app allows you to enter your own expenses, categorize them and have recurring expenses repeated automatically. The paid option gives you the ability to link the app to your bank account, create more than 1 budget/virtual wallet and share budgets with others. A very useful feature is the “budget” page where you can see the remaining budget.

YNAB is a paying app, but it works in a completely different way than the regular budget apps and is based on an envelope system. YNAB’s approach is based on 4 rules :

- “Give every dollar a job” = every expense, no matter how small, must be recorded

- “Embrace your true expenses” = plan ahead for big expenses

- “Roll with the punches” = if you spend too much in a certain category you can rebalance between categories

- “Age your money” = budget targeted expenses for the coming month(s)

This was my blog post about budgeting, in the next blog post I will discuss debt repayment.

This info is for informational, educational and entertainment purposes only, and does not constitute financial, accounting, or legal advice. Please do your own research (disclaimer).

Sources :

(1) Wikipedia. (2019, August 30). Huishoudboekje. Wikipedia. https://nl.wikipedia.org/wiki/Huishoudboekje

(2) Statbel. (2019, November 28). Huishoudbudget. https://statbel.fgov.be/nl/themas/huishoudens/huishoudbudget

(3) NBB. (2021, April 23). Non-financial accounts of the institutional sectors, fourth quarter 2020. www.nbb.be. https://www.nbb.be/doc/dq/e/dq3/histo/nesc20iv.pdf