An important and sometimes underestimated component in raising children is financial education.

Does your child get pocket money? Does your child learn to save or even invest? In this article, I will help you on your way.

Pocket money

Pocket money is a good way to teach your child about money. It is best to start early, for example, from the age of 6. Start with small amounts so that the child learns to save at a young age. As your child gets older, you can increase this amount even further.

It is advisable to teach your child the value of money in everyday life. Explain that you have to work to earn money and that you can only spend money once. Go over the supermarket bill with your child or explain what it costs to go on a day trip together.

It is possible that your child spends all the pocket money at once, or tries to spend money he or she doesn’t have yet :-). Making mistakes is allowed, your child will only learn from it.

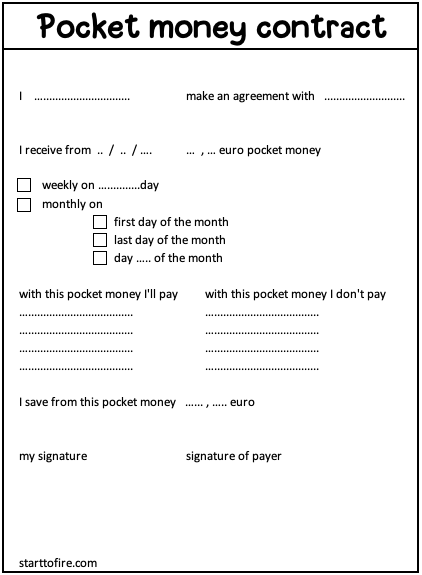

If you still want to make agreements with your child, a pocket money contract may be a good idea.

You can include the following items in this contract :

- How much pocket money do you give.

- At what time does your child receive pocket money.

- What does your child pay with this pocket money.

- What your child does not pay with this pocket money.

- How much your child saves.

Remember to sign this contract together.

Saving

Teach your child to save a portion of the pocket money, you can also include this in the pocket money contract.

At a young age, you can start with a piggy bank, so the child literally sees the money grow :-). If your child wants to save for over one goal, you can also use several piggy banks.

Keeping a savings goal in mind can also be useful, for example toys, game computer or skateboard.

Investing

Of course, it doesn’t hurt to explain the difference between assets and liabilities and explain in a simple way to your child the workings of stocks, dividends, interest, etc. Here we go!

- A stock is a small piece of a company. This stock can quickly go up or down in the short term, for example, after positive or negative news in the press or announcing positive/negative company results.

- If a company makes a profit, it can choose to pay out (part of) this profit to the shareholders. This is called a dividend.

- A bond is a loan, you lend money to a company or government for a certain period. In exchange, you receive interest. Bonds have a lower risk than shares, but the returns are also lower.

If you wish to read more about financial planning, I recommend you to read my blog post build a financial plan.

If you want to learn how to invest in stock funds or rather ETFs (Exchange Traded Fund), which are mutual funds that are tradable on the stock market, then I recommend you to read my blog post invest and stay the course.

Starting early with investing has some advantages :

- Compound interest(1), also called interest-on-interest, works more in your favor with a long investment horizon. Albert Einstein did not call compound interest the eighth wonder of the world for nothing.

- If you have a long investment horizon ahead of you, there is still plenty of time to recover after stock market crashes.

Invest only with money you can miss, you have the risk of (partially) losing your deposit.

A tip to conclude : children take over the behavior of parents, it cannot hurt to set a good example yourself ;-).

This info is for informational, educational and entertainment purposes only, and does not constitute financial, accounting, or legal advice. Please do your own research (disclaimer).

Sources :

(1) Wikipedia. (2021, June 25). Compound interest. Wikipedia. https://en.wikipedia.org/wiki/Compound_interest