When creating your financial plan, one important question usually comes up : how much should I invest to become financially independent?

To answer this question, I refer to past research.

Trinity Study

In 1998, three American professors at Trinity University conducted scientific research on withdrawing funds from assets each year(1).

In this study, the effect of withdrawal rates on portfolio value was measured using the following approach :

- annual withdrawals from assets between 3% and 12%.

- a portfolio comprising stocks (S&P500 index) and long-term high-quality corporate bonds with the reference period between 1926 and 1995.

- asset allocations examined are 100% equities; 75% equities/25% bonds; 50% equities/50% bonds; 25% equities/75% bonds; 100% bonds.

- payout period of 15 years, 20 years, 25 years, and 30 years.

- taxes and costs are not taken into account.

The study aims to calculate a sustainable withdrawal rate (percentage of the original value of the portfolio) where the portfolio does not become depleted despite annual withdrawals.

Results of the Trinity Study

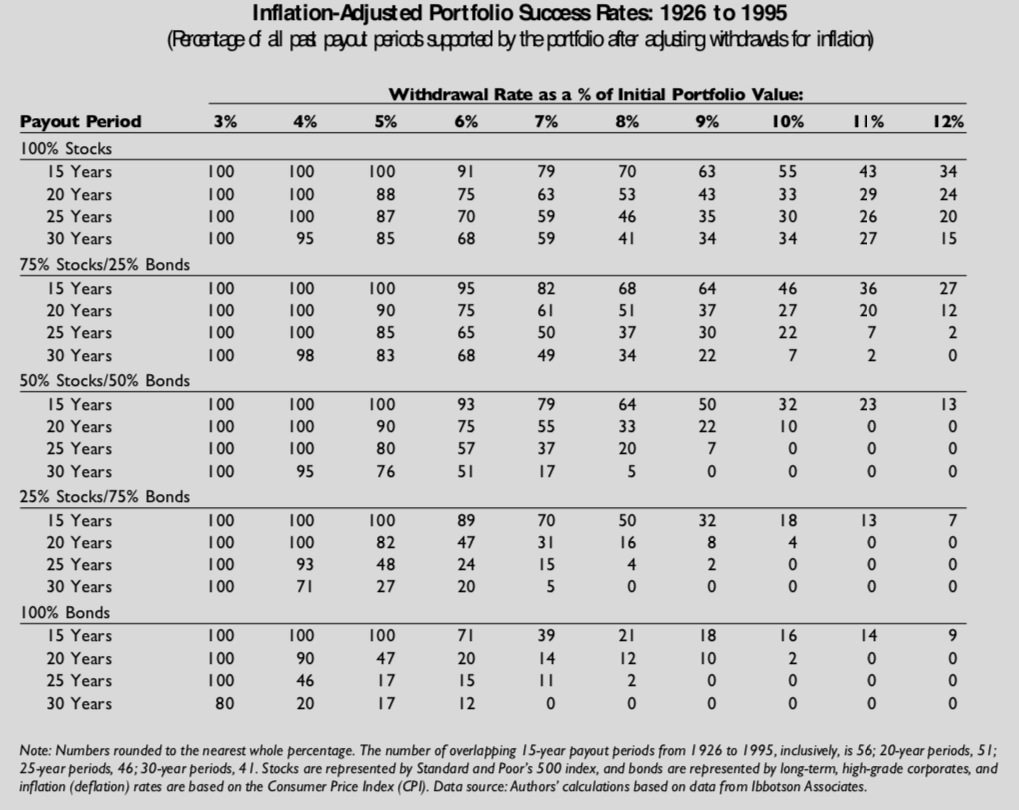

Figure 1 shows success rates for the different asset allocations and payout periods on the vertical axis and withdrawal rates on the horizontal axis.

Inflation has been considered. Specifically, the withdrawal amount in the first year (base amount) is calculated based on the sustainable withdrawal rate. For subsequent payout periods this base amount is increased by inflation.

For example: a portfolio of 500.000 euros, with a withdrawal rate of 4% and inflation of 2% :

- withdrawal 1st year: 20.000 euros (500.000 euros x 4%)

- withdrawal 2nd year : 20.400 euros (20.000 euros increased by 2% inflation)

- withdrawal 3rd year : 20.808 euros (20.400 euros increased by 2% inflation)

How do you read this table? In the study, the professors examined whether portfolios became depleted for all payout periods (15-year, 20-year, 25-year and 30-year) possible in the period between 1926 and 1995.

The first entry in the table shows that portfolios with 100% stocks did not deplete in 100% of all 15-year periods. In these 15-year periods, annual withdrawals were made based on an initial withdrawal rate of 3% of the portfolio value.

We can also read that a 100% equity portfolio was not depleted in 95% of all 30-year periods, with annual withdrawals based on an initial withdrawal of 4% of the portfolio.

What conclusions can we draw from this research?

From the Trinity Study, we can draw some conclusions :

- If we use a sustainable withdrawal rate of 3%, the chance of failure is minuscule.

- if we use a sustainable withdrawal rate of 4%, the chance of failure is small as long as we hold at least 50% stocks, preferably 75% stocks and 25% bonds

- for higher withdrawal percentages, the success rate is higher for shorter periods than for longer periods

The professors also point out that early retirees who expect long(er) payout periods should take lower withdrawal percentages into account.

How much should I invest for financial independence?

This calculation is obviously different for everyone.

You start by calculating your annual expenses, you can do this by creating a budget. Note : do not forget to take inflation into account for your annual expenses. Your annual expenses today are not the same as your expenses in the future. A 2% inflation rate means that a product that costs 100 Euros this year will cost 102 Euros next year.

Then, you determine what withdrawal percentage you want to aim for, you can take 4% for example. If you want to be more conservative, you can choose a withdrawal rate between 3% and 4%, for example.

Let me show you an example

Suppose you want to withdraw 35.000 Euros per year from your assets for 25 years.

- If you choose a withdrawal rate of 4%, you will need to build up invested capital of 35.000 Euros x 25 = 875.000 Euros at the start of the withdrawals.

- If you choose a more conservative withdrawal rate of 3%, you will need to build up invested assets of 35.000 Euros x 33,3 = 1.165.500 Euros at the start of withdrawals.

Suppose you are going to live more frugally and only need to withdraw 25.000 Euros per year from your assets for 25 years.

- If you choose a withdrawal rate of 4%, you will need to build up invested capital of 25.000 x 25 = 625.000 Euros at the start of the withdrawals.

- If you choose a more conservative withdrawal rate of 3%, build up invested assets of 25.000 Euros x 33,3 = 832.500 Euros at the start of withdrawals.

By living more frugally in the run-up to financial independence, and thus reducing your annual expenses, this brings 2 advantages : you can invest 10.000 Euros per year more and need much less capital to become financially independent!

This info is for informational, educational and entertainment purposes only, and does not constitute financial, accounting, or legal advice. Please do your own research (disclaimer).

Sources :

(1) Philip L. Cooley, Carl M. Hubbard and Daniel T. Walz. (1998, February 1). Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable. https://www.aaii.com/files/pdf/6794_retirement-savings-choosing-a-withdrawal-rate-that-is-sustainable.pdf.