Disclaimer : this blog post is primarily written for Belgian investors.

Choosing the right equity ETF is a personal, but also an important decision.

Selection criteria

I select my equity ETFs based on the following criteria.

- Globally diversified : the main reason for this is spreading the risks. Suppose you invest in the stock market and buy shares of 1 company. If this company goes bankrupt, you lose the entire value of your investment. But if you invest in 1000 different companies on the stock market, for example using an ETF, when one company goes bankrupt you don’t lose the entire value of your investment. Therefore, it is best to invest on a global scale, regardless of countries and/or sectors.

- Full replication : the provider of an ETF with physical replication purchases stocks or bonds that are part of the index. A first advantage is transparency, you know perfectly what’s in the ETF. Another advantage is security : the ETF provider effectively owns the stocks/bonds and these are the collateral if the provider goes bankrupt.

- Expense Ratio : the provider of an ETF charges shareholders an expense rate to cover the operational costs of the fund. Here, I’m aiming for a maximum annual percentage rate of charge, also called Total Expense Ratio (TER), of up to 0,50%.

- Accumulating : in Belgium we pay 30% withholding tax on dividends. An accumulating ETF reinvests the dividends, and therefore you don’t have to pay this withholding tax.

- Domiciled in Ireland : Ireland does not tax foreign investors on dividends.

- Issued in euro : you buy or sell the ETF in euro and thus avoid exchange rate costs.

- UCITS : the ETF complies with EU regulations to protect the public from unsuitable investment vehicles.

- Fund size : ETFs are only profitable when they have a certain size, if they are not profitable the fund may close its doors. Smaller ETFs typically have a lower trading volume and are therefore generally less liquid. With a fund size of about 100 million, an ETF can be managed cost-effectively (1).

- Not registered in Belgium : Belgians pay a lower tax on stock exchange transactions (TOB) for each purchase and sale of funds that are not registered in Belgium but are registered in a country of the European Union.

Market capitalization is also important when selecting your ETF. But what is market capitalization? Briefly, this is the “stock market value” and in this, we make a difference between small-caps (small companies), mid-caps (medium companies) and large-caps (large companies). Small-cap companies have a value less than $2 billion, mid-cap companies have a value between $2 billion and $10 billion, and large-caps usually have a value greater than $10 billion (2).

In addition, there are 2 index providers : MSCI and FTSE (Russell). These providers differ in method, the main difference being the classification of certain countries into developed or emerging markets. For example, South Korea and Poland are classified by MSCI as emerging markets, and by FTSE they are classified as developed markets. In terms of company size, there are also differences : some small companies (small-cap) are classified by MSCI in the small-cap segment, but by FTSE they are classified as mid-cap.

Avoid mixing indexes, in other words : choose MSCI or FTSE for your equity ETF(s).

Globally diversified ETFs

Today, you can achieve global diversification by investing in 1 ETF. Below are some examples of ETFs that invest in the entire global market.

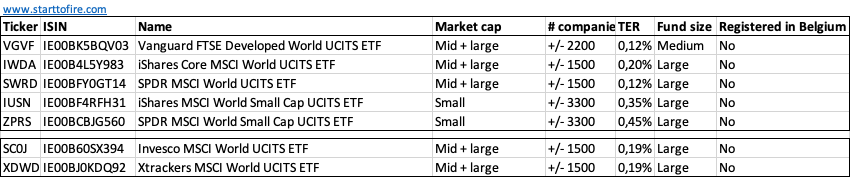

Developed markets

You can also invest in the developed markets.

Emerging markets

If you want to invest in emerging markets you have a choice between the following ETFs.

All ETFs in the tables above also have physical replication, are accumulating, domiciled in Ireland, are issued in Euro and comply with UCITS regulations.

Which ETF do you choose?

Choosing your equity ETF is a personal decision.

The following ETFs are widely chosen by investors investing in the global market :

- VWCE (Vanguard FTSE All-World) invests in mid-cap and large-cap companies.

- A combination of 3 ETFs based on their weight in global market capitalization (3) :

- 76.3% IWDA (iShares Core MSCI World) : invests in mid-cap and large-cap developed markets

- 12.6% EMIM (iShares Core MSCI Emerging Markets IMI): invests in small-cap, mid-cap and large-cap emerging markets

- 11,0% IUSN (iShares MSCI World Small Cap): invests in small-cap developed markets

Alternatively, you can invest in IMIE (SPDR MSCI ACWI IMI). This ETF invests in small-caps, mid-caps and large-caps in the global market, but has a higher annual cost (TER).

For each ETF, you can find more detailed information at www.justetf.com.

I advise you to always read the factsheet and KIID (Key Investor Information Document), these contain important information about the fund!

This info is for informational, educational and entertainment purposes only, and does not constitute financial, accounting, or legal advice. Please do your own research (disclaimer).

Sources :

(1) JustETF. (2021, March 17). Size matters when it comes to ETFs. https://www.justetf.com/uk/news/etf/size-matters-when-it-comes-to-etfs.html

(2) Investopedia. (n.d.). Small Cap. Consulted on 2021,May 29. https://www.investopedia.com/terms/s/small-cap.asp

(3) MSCI indices market capitalisations. Consulted on 2021,May 29. MSCI Indices Market Capitalisations. https://www.hette.ma/marketcap/